XRP Price Prediction: Assessing the Bullish Case Amid Regulatory Crosscurrents

#XRP

- Technical Inflection: XRP shows mixed signals with MACD turning positive while trading below the 20-day MA

- Institutional Validation: $300M+ ETF inflows demonstrate professional investor confidence

- Regulatory Catalyst: Pending SEC appeal and White House policy report could drive volatility

XRP Price Prediction

XRP Technical Analysis: Key Indicators Point to Potential Rebound

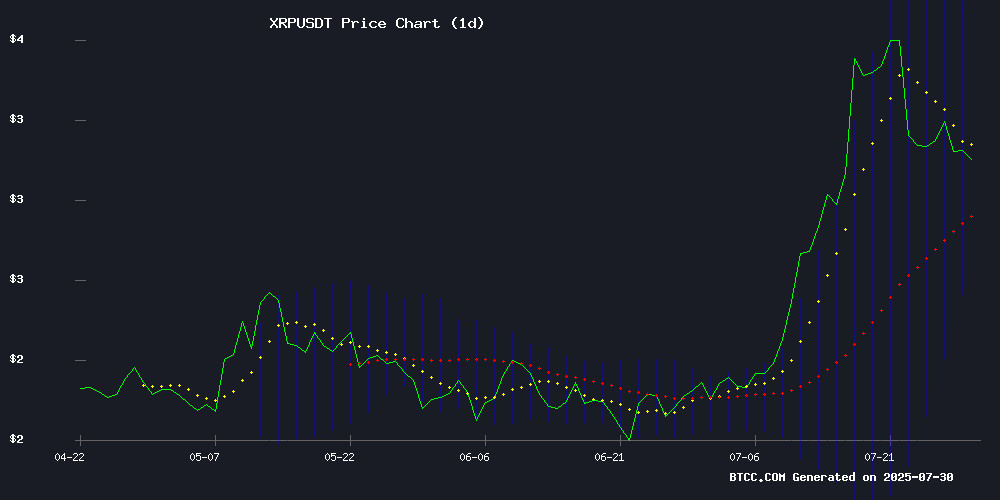

XRP is currently trading at $3.1119, slightly below its 20-day moving average of $3.1668, suggesting a neutral to slightly bearish short-term trend. The MACD histogram shows a positive crossover (0.1195), indicating potential upward momentum. Bollinger Bands reveal price hovering NEAR the middle band, with room to test resistance at $3.6603 or support at $2.6733.

"The technical setup shows XRP is at an inflection point," says BTCC analyst Mia. "The MACD turnaround and current position within Bollinger Bands suggest we could see a rebound if buying pressure returns, though the 20-day MA remains immediate resistance."

Regulatory Developments and Institutional Interest Shape XRP Sentiment

Mixed news flow surrounds XRP as the SEC maintains its appeal stance while institutional products gain traction. Teucrium's Leveraged XRP ETF has attracted over $300 million, capturing 52% market share, signaling strong professional investor interest. Meanwhile, whale activity shows $25 million in long positions being opened ahead of a key White House policy report.

"The ETF flows and whale accumulation counterbalance regulatory uncertainty," notes BTCC's Mia. "The market appears to be pricing in eventual regulatory clarity, with the 20% DeFi yields for retail holders adding another bullish element to XRP's value proposition."

Factors Influencing XRP's Price

Ripple Lawsuit Update: SEC Holds Firm on Appeal as Crypto Community Awaits Next Move

The SEC has yet to withdraw its appeal in the high-profile Ripple case, defying widespread market expectations. Crypto lawyer Bill Morgan notes the regulatory body must report to the appellate court by August 15, 2025—a soft deadline that could force action. "We should hear something within two weeks," Morgan observed, signaling mounting pressure for regulatory clarity.

XRP remains at the center of this legal storm, with its valuation sensitive to each procedural development. The SEC's persistence suggests unresolved tensions between innovation and enforcement—a theme reverberating across crypto markets. Market participants now watch for either a strategic retreat or reinforced litigation from regulators.

XRP Price Analysis - Ripple Faces Pressure at $3.12 Despite Regulatory Progress

XRP trades at $3.12, marking a 2% daily decline, as regulatory optimism from Ripple CEO Brad Garlinghouse's Senate testimony clashes with broader market volatility. The digital asset's RSI sits at 57.22, indicating neutral territory, while MACD signals bearish momentum.

Garlinghouse's appearance before the U.S. Senate Committee on Banking, Housing, and Urban Affairs underscored Ripple's push for comprehensive crypto regulation—a long-term positive for XRP. Yet the market remains fixated on technical levels, with XRP dropping 3.5% to $3.07 earlier this week. Regulatory progress appears decoupled from price action as traders weigh macroeconomic uncertainty against structural tailwinds.

Teucrium's Leveraged XRP ETF Draws Hundreds of Millions as Investor Interest Surges

XRP is emerging as a standout performer in Teucrium Trading's portfolio, with CEO Sal Gilbertie noting unprecedented inflows into its 2x leveraged ETF. The Teucrium 2x Long Daily XRP ETF (XXRP) has attracted hundreds of millions in capital since its launch 16 weeks ago, outpacing all other funds in the firm's 16-year history.

Gilbertie attributes the demand to XRP's growing recognition as a potential store of value and its robust blockchain infrastructure. The cryptocurrency has rallied over 50% in the past month, fueled by what Gilbertie describes as the 'XRP army'—a dedicated community of supporters driving adoption.

Market observers suggest XRP could play a pivotal role in crypto's next growth phase, bridging institutional and retail interest. The ETF's success signals deepening market sophistication as investors seek leveraged exposure to altcoins beyond Bitcoin and Ethereum.

XRP Whales Open $25 Million in Longs Ahead of White House Crypto Policy Report

Cryptocurrency whales have placed $25 million in long positions on XRP, signaling strong bullish sentiment ahead of the White House's forthcoming crypto policy report due July 30, 2025. Market participants speculate the report may favor U.S.-based projects, with XRP positioned as a potential beneficiary.

Technical analysis reveals a bullish pennant formation, suggesting a breakout target of $3.66 could propel XRP toward $5.96 if current momentum persists. The convergence of institutional positioning and regulatory developments has created fertile ground for a potential XRP rally.

90% of Finance Leaders Expect Blockchain to Transform Industry Within 3 Years

Nine out of ten global finance leaders predict blockchain technology and digital assets will revolutionize the financial sector by 2027, according to a Ripple survey. The findings highlight mounting institutional confidence in distributed ledger technology's capacity to enhance transparency, streamline operations, and fortify security across traditional finance.

Payment systems and settlement infrastructure appear poised for the most immediate disruption, with respondents forecasting rapid adoption of crypto-based solutions. This accelerating convergence between decentralized protocols and mainstream finance underscores blockchain's evolution from speculative experiment to foundational technology.

XRP emerges as a notable beneficiary of this trend, with Ripple's positioning at the intersection of institutional finance and blockchain innovation. The survey results suggest a tipping point approaching for enterprise adoption, potentially catalyzing new liquidity waves across crypto markets.

Teucrium’s 2x XRP ETF Surpasses $300M in Flows, Captures 52% of Market Share

Teucrium's 2x Long Daily XRP ETF (XXRP) has eclipsed $323.6 million in net flows, becoming the first US-traded XRP ETF to break the $300 million barrier. The fund now commands 52.5% of the $616 million total inflows across all US XRP ETFs, according to VettaFi data.

All US XRP exchange-traded products remain derivative-based as the SEC continues to withhold approval for spot products. XXRP's dominance follows a 22.7% weekly inflow growth, including a record $50.4 million single-day volume on July 21.

Volatility Shares' competing products—XRPI (non-leveraged) and XRPT (2x leveraged)—posted $33.6 million and $43.6 million inflows respectively last week, representing 26-27% growth. ProShares' Ultra XRP ETF (UXRP), launched July 16, rounds out the field of four US XRP ETFs.

XRP Price Stumbles to $3.12: Sharp Correction or Golden Opportunity Ahead?

XRP faces a critical juncture as its price hovers near the $3.15 support level, a threshold that could determine its near-term trajectory. A breach below this level may see the cryptocurrency test $3, presenting what analyst Ali Martinez describes as a 'buy-the-dip' opportunity.

Profit-taking has intensified following sales by Ripple co-founder Chris Larsen, contributing to a 10% weekly decline from its all-time high of $3.65. Market sentiment has further weakened due to lingering uncertainty around the Ripple vs SEC lawsuit and technical chart indicators.

On-chain data reveals a silver lining: XRP remains 46% higher over the past month, with dormant coins re-entering circulation—a sign of long-term holder accumulation. The average investment age has decreased by 91 days to 593 days, suggesting renewed market participation.

XRP Price Prediction: Bears Gain Momentum as Key Support Holds

XRP faces mounting bearish pressure as trading volume spikes and bullish momentum wanes. The cryptocurrency clings to a critical support zone between $3.07 and $3.12, aligned with its 20-day Exponential Moving Average at $3.06. This level has repeatedly defended against deeper declines since XRP's breakout above $3.00.

Technical indicators reveal weakening momentum, with the Relative Strength Index retreating from overbought territory at 72.76 to 57.86. Derivatives markets reflect growing caution—open interest dropped 7.32% despite a 38.25% surge in trading volume to $13.7 billion, suggesting long positions are being unwound.

The Wyckoff accumulation pattern forming on charts hints at potential breakout opportunities, but traders await confirmation. Upside targets remain at $3.35 and $3.50, provided support holds. Market participants watch for either a decisive breakdown or renewed accumulation that could reignite bullish momentum.

Crypto: Is Now the Time to Buy XRP Ahead of a Surprise ETF Announcement?

XRP is weathering market turbulence but remains firmly in investors' crosshairs. A clarified legal framework and growing speculation around a potential ETF are fueling renewed institutional interest. The token's resilience suggests a possible resurgence in the crypto spotlight.

Market observers note parallels with Ethereum's ETF-driven momentum, though XRP's path remains uncertain. The SEC's abrupt suspension of Bitwise's crypto index fund conversion has introduced fresh volatility, yet analysts see underlying strength in Ripple's positioning.

Despite a 7% single-day drop following regulatory uncertainty, technical indicators point to accumulation. Some charts suggest a potential rebound trajectory toward $5, though market makers appear to be testing support levels. The recent large transfer by Chris Larsen sparked temporary concern, but on-chain data reveals most holdings remain locked.

Chris Larsen Under Pressure After A Massive Transfer Of XRP – Is It Disguised Dumping?

Ripple co-founder Chris Larsen moved 50 million XRP, valued at $175 million, during a period of peak pricing at $3.60 per token. The bulk of these funds—approximately $140 million—was directed to exchange platforms, sparking speculation about strategic profit-taking ahead of a potential market downturn.

This follows a similar transfer of 50 million XRP in September 2024, raising concerns about recurring liquidity risks. Market observers question whether such large-scale movements undermine stability or reflect routine portfolio management.

XRP's subsequent price decline has amplified unease among investors, with the timing of Larsen's transactions fueling debate over hidden dumping tactics. The lack of clarity around intent leaves the market parsing the implications for broader crypto confidence.

Retail XRP Holders Gain Access to 20% Yield Through DeFi Protocol

MoreMarkets has introduced an XRP Earn Account, enabling retail investors to participate in yield strategies previously limited to institutional players. The product targets the multibillion-dollar opportunity in idle XRP holdings by offering curated DeFi strategies while preserving self-custody—a first for the XRP ecosystem, which lacks native staking mechanisms.

The platform automates capital deployment across vetted DeFi protocols via smart contract vaults, maintaining user control over withdrawals. Security audits were conducted by Halborn, Sherlock, and Sigma Prime, with onboarding simplified through email or wallet connections.

"We're merging fintech accessibility with DeFi's yield potential," said Altan Tutar, CEO of MoreMarkets. "Retail investors have been sidelined with sub-2% returns while institutions captured 20%+ yields." The solution utilizes cross-chain infrastructure similar to wrapped assets like WBTC.

Is XRP a good investment?

XRP presents a compelling but nuanced investment case as of July 2025. The technical and fundamental factors suggest:

| Factor | Bullish Indicators | Bearish Risks |

|---|---|---|

| Technical | MACD positive crossover, Middle Bollinger Band support | Price below 20-day MA |

| Institutional | $300M+ ETF inflows, Whale accumulation | SEC appeal uncertainty |

| Yield | 20% DeFi yields available | Regulatory scrutiny on yield products |

"XRP offers asymmetric upside if regulatory clarity emerges," says BTCC's Mia. "The $2.67-$3.66 range will likely hold until we get definitive policy direction, making current prices attractive for patient investors."

XRP represents a high-risk, high-reward opportunity suitable for investors with multi-year horizons and tolerance for regulatory uncertainty. The combination of technical rebound potential, institutional adoption, and yield opportunities creates a favorable risk/reward profile at current levels.